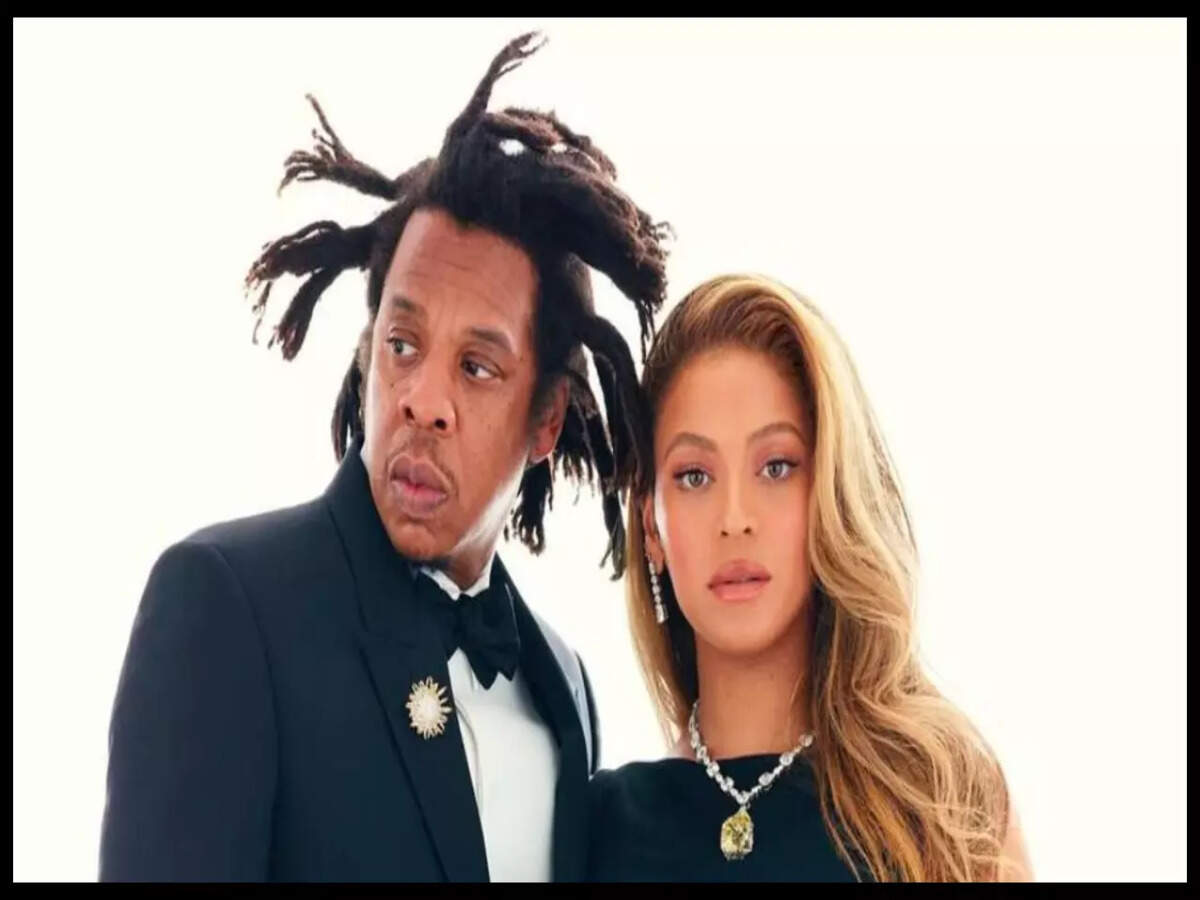

Why Jay-Z and Beyoncé’s $57M Mortgage Isn’t a Sign of Financial Trouble

When you think of Jay-Z and Beyoncé, two of the most successful entertainers and entrepreneurs in the world, the idea of them carrying a $57 million mortgage might seem surprising.

After all, their combined net worth is estimated at around $3.3 billion. So why would billionaires take on such a large loan? The answer lies in smart financial strategies rather than financial distress.

According to property records, the couple secured a $57.75 million mortgage on their $88 million Bel-Air mansion in April 2025. This is in addition to a previous $52.8 million mortgage taken out four years earlier.

Some online commentators have speculated that this means the couple is “broke billionaires,” but that’s far from the truth.

Instead, Jay-Z and Beyoncé are likely employing a savvy approach to wealth management that many high-net-worth individuals use to maximize their financial flexibility and tax advantages.

The “Buy, Borrow, Die” Strategy Explained

The mortgage strategy Jay-Z and Beyoncé are using is often referred to as “Buy, Borrow, Die.”

This method involves purchasing appreciating assets such as real estate, stocks, or artwork, then borrowing against those assets to access cash without selling them.

This allows the owners to maintain ownership and benefit from long-term appreciation while using the borrowed funds for other investments or expenses.

By taking out mortgages on their Bel-Air property, Jay-Z and Beyoncé can leverage their real estate holdings to free up capital.

This capital can then be invested in their various business ventures or diversified portfolios, potentially generating higher returns than the mortgage interest rates they pay.

Moreover, the interest rates on their mortgages are quite favorable.

The new mortgage from Morgan Stanley’s Private Bank Group has a 30-year term with a fixed interest rate of 5% for the first 10 years, while the previous mortgage from Goldman Sachs carries an even lower rate of 3.15%.

These rates are significantly below the average 30-year mortgage rate of 6.6% as of August 2025, making borrowing an attractive option.

Tax Benefits and Wealth Preservation

One of the key advantages of the “Buy, Borrow, Die” strategy is its tax efficiency. By borrowing against their assets instead of selling them, Jay-Z and Beyoncé avoid triggering capital gains taxes.

When they eventually pass on their estate to their children—Blue Ivy, Rumi, and Sir—the tax basis of the assets resets, potentially saving millions in capital gains taxes for their heirs.

This approach also minimizes opportunity costs. Instead of locking up $110 million in cash by paying off the property outright, the couple can keep their money working in other investments that may yield higher returns over time.

For example, the S&P 500 has delivered an average annual growth rate of 13.66% over the past decade, far exceeding their mortgage interest rates.

What This Means for Everyday Homebuyers and Investors

While Jay-Z and Beyoncé’s financial moves might seem out of reach for most people, the principles behind their mortgage strategy can be applied on a smaller scale.

Using debt strategically to acquire appreciating assets can help build wealth over time. However, it’s important to borrow responsibly and only for investments that are likely to increase in value.

For most homeowners, taking on a mortgage to buy a home is a common way to build equity. Similarly, business loans can provide the capital needed to start or grow a venture.

The key is to avoid high-interest personal loans or credit card debt for non-investment purposes, as these can erode wealth.

Shopping around for the best mortgage rates and negotiating terms can also make a significant difference. Even small reductions in interest rates can save thousands of dollars over the life of a loan.

Tools like Mortgage Research Center (MRC) can help borrowers compare offers from multiple lenders quickly and confidently.

Maintaining a Healthy Debt-to-Income Ratio

Financial advisors recommend keeping your debt-to-income ratio below 41% to manage risk effectively.

Jay-Z and Beyoncé’s mortgage debt represents only about 3.4% of their combined net worth, which is a very conservative level of leverage.

This balance allows them to enjoy the benefits of borrowing without jeopardizing their financial stability.

Beyond Real Estate: Diversifying Wealth Like Jay-Z and Beyoncé

The Bel-Air mansion is just one part of the couple’s extensive $313 million real estate portfolio, which also includes properties in the Hamptons, Malibu, and New York City. But their wealth extends far beyond real estate.

They own stakes in luxury brands such as D’USSÉ and Armand de Brignac, hold a valuable music catalog, and possess a museum-quality art collection.

For individuals with diverse assets, keeping track of net worth can be challenging. Platforms like Kubera offer a unified dashboard that consolidates real estate, stocks, crypto wallets, and private equity into one view.

This real-time insight helps investors make informed decisions and optimize their wealth growth strategies.

Alternative Ways to Invest in Real Estate

Not everyone can or wants to buy expensive properties or take on large mortgages. Fortunately, there are alternative ways to invest in real estate with lower barriers to entry. For example, Homeshares allows accredited investors to access the $34.9 trillion U.S. home equity market with a minimum investment of $25,000. This fund invests in owner-occupied homes across major U.S. cities, offering returns between 12% and 18% without the hassles of property management.

Similarly, commercial real estate platforms like FNRP provide access to institutional-quality investments in essential retail properties, such as those leased to Kroger, Walmart, and Whole Foods. These investments can serve as a hedge against inflation and economic volatility.

Jay-Z and Beyoncé’s $57 million mortgage is far from a sign of financial trouble. Instead, it’s a smart, strategic move that leverages their assets to maximize wealth, minimize taxes, and maintain financial flexibility. Their approach highlights how even the ultra-rich use debt as a powerful tool for wealth management.

If you’re inspired by Jay-Z and Beyoncé’s financial savvy, consider exploring how strategic borrowing and diversified investments can work for you. Whether you’re buying a home, investing in real estate funds, or managing a portfolio of assets, smart financial decisions can help you build and preserve wealth over the long term.

Ready to take control of your financial future? Start by comparing mortgage rates today with trusted platforms like Mortgage Research Center and explore investment opportunities that fit your goals. Your path to smarter wealth management begins now!

News

My daughter left my 3 grandkids “for an hour” at my house but she never came back. 13 years later, she came with a lawyer and said I kidnapped them. But when I showed the envelope to the judge, he was stunned and asked: “Do they know about this?” I replied: “Not yet…

The gavel slams down like a thunderclap in the hushed Houston courtroom, shattering the silence that’s choked my life for…

MY SISTER AND I GRADUATED FROM COLLEGE TOGETHER, BUT MY PARENTS ONLY PAID FOR MY SISTER’S TUITION. “SHE DESERVED IT, BUT YOU DIDN’T.” MY PARENTS CAME TO OUR GRADUATION, BUT THEIR FACES TURNED PALE WHEN…

The morning sun cut through the tall oaks lining the campus of a small university just outside Boston, casting long,…

I JUST SIGNED A $10 MILLION CONTRACT AND CAME HOME TO TELL MY FAMILY. BUT MY SISTER PUSHED ME DOWN THE STAIRS, AND WHEN -I WOKE UP IN THE HOSPITAL MY PARENTS SAID I DESERVED IT. DAYS LATER, MY WHOLE FAMILY CAME TO MOCK ME. BUT WHEN THEY SAW WHO STOOD NEXT ΤΟ ΜΕ, DAD SCREAMED: ‘OH MY GOD, IT’S…

The courtroom fell into a sudden, heavy silence the moment I pushed open the massive oak doors. Every eye turned…

During Sunday Dinner, They Divided My Home — My Legal Team Crashed The Party — A Lawyer Pulled Out the Original Deed and Reversed the Partition in Minutes

The buzz of my phone cut through the quiet hum of my office like a siren. Outside the window, downtown…

My Family Banned Me From the Reunion — So I Let Them Walk Into the Beach House I Secretly Owned — They Opened a Closet and Found the Papers That Shattered Our Family

The email arrived like a paper cut. Small, quick, and bloodless — until it stung.It was a Tuesday morning in…

She Donated Blood — The Recipient Was a Dying Mafia Boss Who Wanted Her Forever — Hospital Records and Phone Logs Show He Tried to Track Her Down

Rain hit the pavement like bullets — each drop a metallic whisper cutting through the night. I stood there, soaked…

End of content

No more pages to load